EDITOR’S NOTE: We usually post Representative Gomberg’s updates on Tuesday … We share his updates as many of the issues that impact Lincoln County also impact Tillamook County, and he provides a great review/update of what’s happening at the State Capitol.

By Representative David Gomberg, House District 10

2/9/2026

Dear Friends and Neighbors,

Earlier this week, a reporter jokingly asked me who I’d made mad. “You seem to be right in the middle of every white-hot issue this session.”

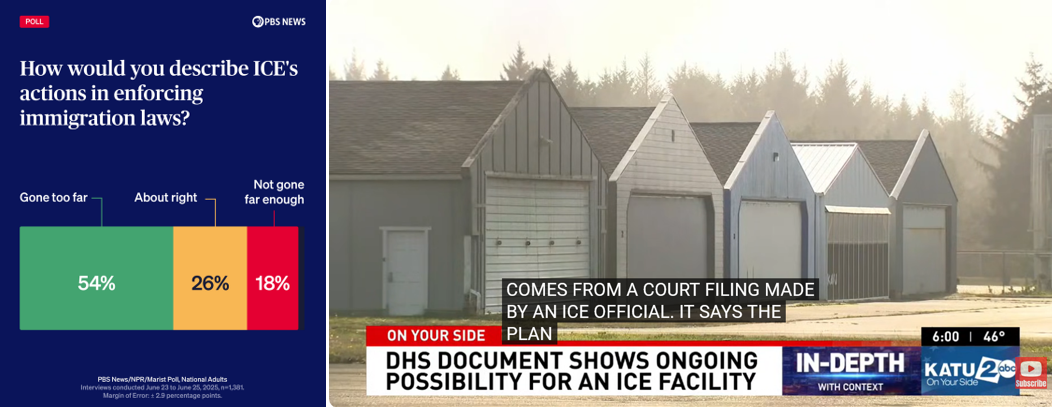

Well, it’s true. I co-chair the budget committee responsible for ODOT and the need to reduce spending by nearly $300 million. ICE and immigration are front and center with the ongoing potential for Oregon’s only detention and deportation center in Newport. I’m vice chair of the Ways and Means Committee that needs to reduce overall spending by $750 million in addition to the ODOT cuts. And this week, I was appointed to co-chair the committee tasked with considering shifting the gas tax vote from November to May.

I was even the chair of the usually innocuous Rules Committee that got caught up in an early first-day debate over whether members could accept campaign contributions while we are in legislative session. Republicans said yes and Democrats no.

There’s a reason I’m tired when I finally get home at night!

The Senate President detailed in his own newsletter this week the three big priorities this session: responding to federal overreach, improving affordability and prosperity for Oregonians, and rebalancing the state budget.

There is work happening in both the House and the Senate putting a package of legislation together to address the actions of ICE agents and the fear we are hearing from our local communities, particularly after the tragedies in Minneapolis. (see below)

There will also be legislation on the cost of living, building on work we’ve done in recent sessions around prescription drug prices, utility costs, junk fees, affordable housing, zoning and permitting.

But the biggest conversation this year will be around the budget. The Legislature is required by the Oregon Constitution to have a balanced budget on a two-year cycle. Coming out of the 2025 legislative session, we budget writers crafted a tight budget with a small extra cushion and money set aside in reserves.

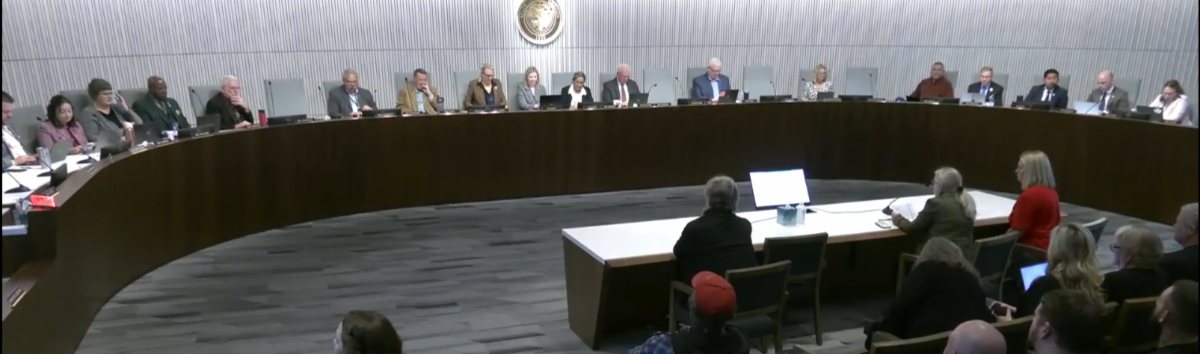

Tuesday night, the Ways and Means Committee took testimony from hundreds of Oregonians about possible budget cuts. You can watch the hearing here.

Tuesday night, the Ways and Means Committee took testimony from hundreds of Oregonians about possible budget cuts. You can watch the hearing here.

Just a few days after we ended the 2025 session, President Trump signed his tax cuts bill into law, immediately punching a $900 million hole in Oregon’s budget and sending us into the red. Additionally, this bill cut $15 billion in federal funds from Oregon over the next six years, largely from federal health care and food assistance programs.

Simply put, if that bill wasn’t signed into law, Oregon would be in a positive fiscal position and would not need to be considering programmatic reductions or cuts.

As far as who benefits from the Trump cuts, according to the nonpartisan Congressional Budget Office, overwhelmingly the richest Americans will pay less, while our neighbors who rely on Medicaid or SNAP are going to be harmed.

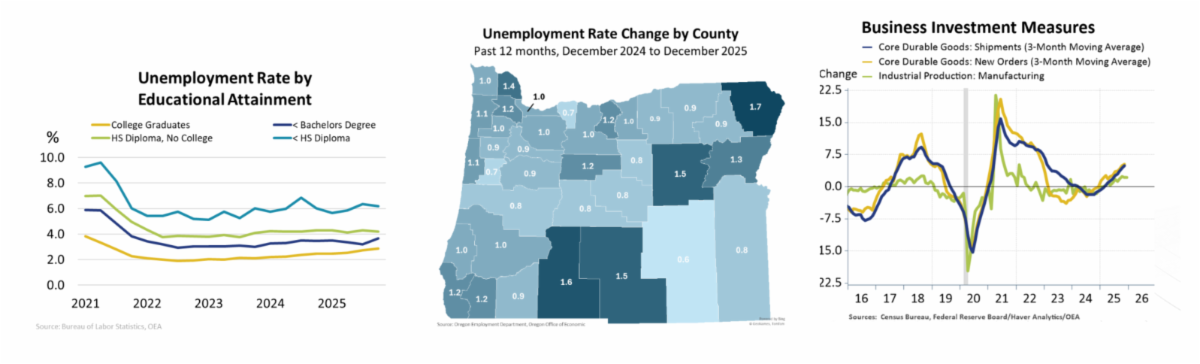

It’s clear that Oregon will need to make some tough choices about what projects and programs the state can afford to support and how we spur economic growth in the long-term.

As lawmakers wrestle with a deficit that is all but certain to require state service cuts, a revenue forecast made public Wednesday suggests we can plan for about $100 million more in the state’s general fund than previously expected.

The latest forecast shows a jump in expected corporate taxes of $95 million that more than offsets personal income taxes now projected to come in $42 million lower than they were three months ago. Other revenue sources for the general fund are projected to be up $52 million. In total, the state’s general fund revenues are up $106 million from the previous forecast. Lawmakers can also plan for around $50 million more from the Oregon Lottery and the state’s corporate activity tax on business sales. Both will help boost school funding.

But to be clear, the updated numbers represent a tiny fraction of the state’s $37 billion general fund budget for the biennium that began in July.

| Your legislature gaveled into this year’s five-week session on Monday figuring we’d need to find about $750 million to balance the state’s general fund and leave money aside for emergencies. Now we’re looking at a gap that is closer to $650 million. Still in question is how legislators will fill the hole. On Tuesday evening, the Ways and Means Committee took hours of testimony from Oregonians who’d signed up to testify — often passionately — for programs that had been suggested as potential cuts by state agencies.

Do we cut budgets, minimize tax cuts, spend reserves, or raise revenue? Two contrasting perspectives are emerging.

Jake Cornett, executive director and CEO at the advocacy group Disability Rights Oregon, said in a statement: “The choice for Oregon lawmakers is clear—they can cut their way to a balanced budget and inflict pain on Oregonians with disabilities, or they can trim spending where appropriate, eliminate tax cuts for the ultra-rich and mega corporations, and use Oregon’s reserves.”

Senate Republican Leader Bruce Starr, R-Dundee, said in a statement: “Raising costs on businesses and middle-income Oregonians right now is indefensible, and voters have already rejected this approach in overwhelming fashion. With additional resources on the table, Democrats are deliberately choosing to suppress economic growth and shrink our tax base.”

A compromise proposal unveiled Monday would keep some tax reductions and reclaim nearly $300 million by severing the state from three tax breaks included in the federal bill. At the same time, Oregonians can expect a $1.4 billion tax kicker refund this year.

Read more in OPB and the Oregonian. |

|

| Ryan Tribbitt, in his column, The Political Center, wrote that when lawmakers created the short session more than a decade ago, the intent was narrow and pragmatic: to make technical budget adjustments, clean up unresolved issues, and pass low-hanging fruit, while largely deferring most major policy decisions to the next long session.

Over time, short sessions have increasingly become a place to introduce legislation establishing negotiating positions, signal governing priorities for the election underway, and plant flags for the next long session. Bills are introduced to begin discussions rather than to resolve them. And this session, were dealing with an odd undertone with one Republican in the House running for Governor and one Republican Senator doing the same.

I’ve often been asked as the session got started, what we are doing about ICE and concerns that Oregon could be among the next states to face a Minneapolis-style federal surge involving one or more federal enforcement entities.

In the House, the emphasis has been on how federal authority operates physically within Oregon’s borders. Proposed legislation is focused on immigration enforcement, law-enforcement cooperation, and National Guard participation, narrowing the circumstances under which state resources or personnel may be used in support of federal action.

The Oregon Senate is more focused on the systems that make enforcement and federal pressure possible in the first place, such as the flow of information, data usage, election administration, public lands, health care oversight, and long-term financial exposure.

- HB 4150 limits the use of state contractors or grant funds for deportation transportation without a federal court order.

- HB 4111 restricts the use and disclosure of immigration-status information and expands protections against retaliation.

- HB 4079 would direct school districts to adopt a response plan for when immigration officers enter the premises.

- HB 4138 limits state and local participation in certain federal or out-of-state law enforcement operations and establishes transparency and civil-liability requirements.

- HB 4114 requires notice, identification, and procedural limits for federal or out-of-state law enforcement activity in Oregon.

- HB 4091 limits National Guard mobilization and bars Guard participation in immigration enforcement without explicit state authorization.

- HB 4117 creates a state funded immigration legal representation program outside federal systems.

- HB 4001 directs the Department of Justice to study unlawful immigration enforcement and potential state responses.

- SB 1594 directs development of model policies governing immigration-status data and federal access to public facilities.

- SB 1587 restricts data brokers from providing personal data for civil law-enforcement purposes without a court order.

Again, much of this information was taken from The Political Center. You can subscribe to this thoughtful report here.

Several bills regarding immigration enforcement were debated in committees this week. Collectively, these measures constrain access to state manpower, facilities, contractors, and informal cooperation, increasing the likelihood that federal actions trigger litigation and judicial review. That said, there is a broad consensus that violent criminals without legal status should be deported to their home countries. |

|

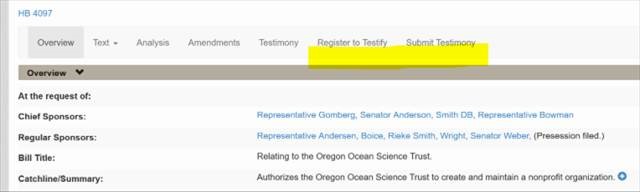

| I understand and respect that opinions will vary about these bills and others being considered this session. And I want to hear from you! I receive and read hundreds of emails each week. I respond to all I get from constituents.

Contacting your legislator is one way to effect legislation. Another is to comment directly for the record when committees hear proposals. You can do that in person, virtually on your computer, or in writing.

Register to testify!

- If there is a bill you are particularly passionate about, you can register to testify either in support or opposition to the bill.

- Advance registration is required! Registration closes 30 minutes before the hearing is scheduled to begin.

- To register, go to olis.oregonlegislature.gov, select the “Bills” icon on the top right corner of your page, enter the bill number, and select “Register to Testify.” Or, call 1-833-588-4500.

- You will want to fill out the “Public Testimony Registration Form.”

- You will receive an email confirmation with an option to join Microsoft Teams if you cannot testify in person.

Submit a Written Testimony!

- If you prefer not to testify in person, you can also submit written testimony in support or opposition to a bill.

- To submit written testimony, follow the same steps as you would to register to testify in front of the committee, but you will select “Submit Testimony” and fill out the “Written Testimony Submission Form.”

- Written testimony must be submitted up to 48 hours after the committee meeting start time.

|

| The Oregon Legislative Website and the Oregon Legislative Information System (OLIS) have an abundance of resources to use for following along with the Legislative Session. Visit www.oregonlegislature.gov to find out:

Find many more ways to explore and engage by visiting the “Get Involved” tab. |

|

| In other news, downtown Lincoln City has more orange than Corvallis on game day! There are hundreds of warning cones, lane closures, and blocked businesses as every crosswalk in town is replaced. This is the second year of construction with dozens of curb cuts placed in Lincoln Beach last year that seemed to lead to nowhere.

At a time when we are challenged by declining ODOT budgets, many good folks are asking me what is going on. |

| I must admit that I share your frustration. It’s hard to live with this project, year upon year, watching the cones and crews move from corner to corner. Those ramps that open to non-existent crosswalks, not far from actual, well-marked crosswalks, are perhaps the most mysterious of all. Curb work continues on Highway 101 from Otis south to Lincoln Beach.

This local project is the result of a landmark lawsuit filed more than a decade ago by the Association of Oregon Centers for Independent Living, alleging that the Oregon Department of Transportation was in violation of the Americans for Disabilities Act. In addition to the AOCIL, eight individual plaintiffs joined the suit including a resident of Lincoln City. This disabled veteran said that due to the lack of curb ramps he was unable to make his way to everyday destinations like the library, in his electric scooter. |

| As part of the settlement, ODOT agreed to bring an estimated 10,000 curb ramps and 1,500 pedestrian signals into compliance, throughout the state but with special concentrations in areas that were most hazardous. Our section in north Lincoln County will cost about $22 million and is due to be completed later this year. You can learn a bit more here: Project Details | Transportation Project Tracker

Last year, I inquired about those ramps that appear to open to nowhere. I was told that these are designed for the future users of the lots adjacent. Even if the lot is not developed in this way now, there may come a time in the future in which that property owner would like to use their allowable egress to Highway 101. With this design, the future owner will not be tasked with the expense of cutting through the sidewalk, designing and building their own ADA-compliant curb ramps. They will already be in place.

That’s their story. At the end of the day, I understand we need sidewalks that are easier and safer for everyone to use. I just hope it’s done by the Fourth of July!

Week one of the short session is behind us and four more are looming. As always, I strive for rational, reasonable bipartisan solutions. We don’t aways agree. But we do need to listen to and respect each other in the process.

I’ll be back with a review of week two next Monday. |

|

Tuesday night, the Ways and Means Committee took testimony from hundreds of Oregonians about possible budget cuts. You can watch the hearing here.

Tuesday night, the Ways and Means Committee took testimony from hundreds of Oregonians about possible budget cuts. You can watch the hearing here.

(2).png)