EDITOR’S NOTE: Here’s an installment from Tillamook County’s State Representative Cyrus Javadi’s Substack blog, “A Point of Personal Privilege” Oregon legislator and local dentist. Representing District 32, a focus on practical policies and community well-being. This space offers insights on state issues, reflections on leadership, and stories from the Oregon coast, fostering thoughtful dialogue. Posted on Substack, 8/11/25

By State Representative Cyrus Javadi

Unpacking the six-cent fury, the real cost of doing nothing, and why trust is the pothole no one’s fixing.

There’s a special kind of fury that surfaces when someone in government says, “We’re just asking for six cents more.”

Six cents. That’s what’s being proposed. A small bump on the gas tax, six pennies per gallon. The sort of thing that, on its face, shouldn’t even register. And yet.

It feels like betrayal.

Because you’re still stuck in the same traffic jam you were twenty years ago. Still bouncing over the same bump on the same coastal highway that’s been sliding since Clinton played the saxophone on Arsenio. Still holding your breath crossing a bridge you suspect is held together by duct tape, prayers, and a rotating crew of interns.

So yeah, people are mad. Not because six cents is outrageous. But because nothing ever seems to change, and they’re the ones being told to pay for it.

And here’s the twist: they’re not wrong to feel that way. But the full story?

It’s more complicated, and worth hearing.

Invisible Fixes Make for Bad Politics

Let’s start here: when your power bill goes up, at least the lights stay on. The fridge hums. The heat works. You can point to the value.

When your gas tax goes up? Nothing obvious happens.

No golden guardrails. No fresh pavement. No billboard that says, “Welcome to Milepost 94! Brought to You by Your Higher Fuel Tax.”

And that’s part of the problem. The gas tax funds stuff that doesn’t happen: bridges that don’t collapse, culverts that don’t flood, slopes that don’t wash out. These are quiet victories. Which is great for engineers. Terrible for PR.

So what people see (what they remember) isn’t the avoided disaster. It’s the ongoing decline. The unpatched cracks. The “Road Work Ahead” sign that’s been ahead of you since the Bush administration.

When there’s no visible improvement, any new tax (even six cents), feels like paying for failure.

OK, But What Does Six Cents Actually Cost You?

Let’s do the math. You drive about 12,000 miles a year. Your car gets 25 miles per gallon. That means you’re buying around 480 gallons of gas annually.

Six cents per gallon? That’s $28.80 a year. Just over two bucks a month. The kind of money most of us have lost under the seat cushions.

And yet, it doesn’t feel small. Why?

Because gas already feels expensive. Because the price jumps a dime overnight and never comes back down. Because we’re already angry before we even touch the nozzle.

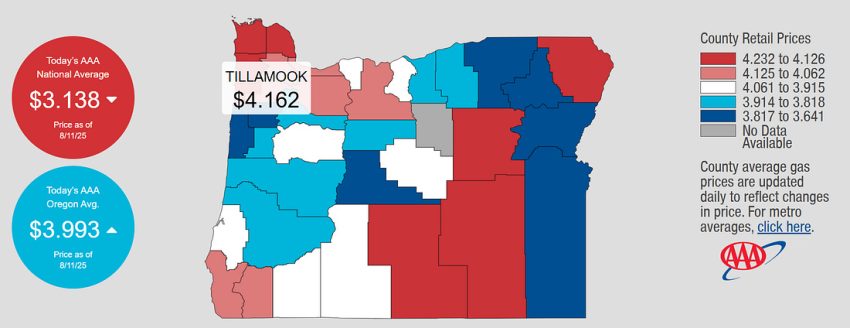

But here’s the part we rarely think about: the gas tax isn’t why you’re paying four bucks a gallon (click here for a map of gas prices across the US).

Most of that cost, like over half, is driven by the global price of crude oil. Which means it’s shaped by Saudi Arabia, OPEC, refinery output, supply chain kinks, and whatever tantrum Putin decides to throw this week.

Then, add in refining costs, shipping, storage, and the gas station’s markup, and you’ve accounted for nearly everything.

The actual taxes? State and federal combined, it’s about 58 cents per gallon in Oregon. If we raise it by six cents, that takes us to 64.

In other words, for every four-dollar gallon, a little over sixty cents goes to taxes. The rest is out of Oregon’s hands.

So yes, six cents is real money. But it’s not why gas feels unaffordable. It’s just the only part we put a politician’s name on.

A Use Tax: Still the Most Honest Deal in Government

The gas tax is what’s known as a “use tax.” You pay it when you use the roads. If you don’t drive, you don’t pay. It’s one of the cleanest, most transparent funding mechanisms we’ve got.

That’s different from how we fund public transportation. In Oregon, there’s a 0.1% payroll tax that helps support local transit services. That means even if you don’t ride the bus, a small piece of your paycheck helps keep it running. And that’s not a bad thing. But it is a totally different way to fund transportation.

A lot of people rely on public transportation to get to work, school, the grocery store. And, in smaller communities, it’s often the only affordable, accessible option for those who can’t drive or choose not to. It deserves to be funded, and improved.

But that’s exactly what sets the gas tax apart: you only pay it when you drive. There’s a direct connection between what you use and what you fund. At least, that’s how it used to work, until electric vehicles and hybrids started gliding through the system without stopping at the pump. And that’s where the fairness starts to unravel.

Consider this: a typical gas-powered car that gets 25 miles per gallon and drives 12,000 miles a year burns through about 480 gallons of fuel. At Oregon’s current 40-cent-per-gallon state gas tax, that driver pays $192 a year into the road fund. By comparison, an electric vehicle pays an extra $115 a year in registration fees—unless the owner opts into OReGO, the pay-by-mile program, which would cost them about $228 for the same mileage. In other words, unless they’re in OReGO, most EV owners are paying significantly less toward road upkeep than the average gas-powered driver.

That’s not sustainable. And it’s not fair, either.

How Rural Counties End Up Getting the Bill

Here’s something most people don’t realize: Oregon doesn’t just spend gas tax money directly, it splits it. By law, 50% goes to the state, 30% to counties, and 20% to cities.

Even if a county has massive needs, it only gets its slice of the 30%. And that slice gets divvied up using factors like population and vehicle registration. Which is where rural counties, especially along the coast, lose out.

Take Tillamook or Clatsop. Modest populations. Modest number of locally registered cars. But millions of visitors every year. Visitors who drive, park, brake, and bottleneck on roads that the locals are expected to pay for.

Because the state funding formula doesn’t account for visitor impact. Just residents and registrations. Which means the folks hosting the party are stuck footing the bill, and mopping up the damage.

And rural roadwork isn’t cheap. Longer stretches. Harsher terrain. Storm damage. Fewer detours. Higher per-mile costs. But when the state looks at where to spend its money, it chooses projects that serve the most people. That almost always favors urban centers.

So rural counties pay more, get less, and wait longer. That’s the pattern. It’s not spite. It’s just math. But math can still be brutal.

And Let’s Not Pretend Our Roads Are Safe

This isn’t just about comfort or convenience. Oregon’s roads are among the most dangerous in the country, especially when measured by miles traveled.

And we know why. Slide zones. Blind corners. Shoulderless highways. Decades-old bridges. Weather-beaten pavement. Intersections that feel like they were designed by a bored teenager in a video game.

These problems don’t fix themselves. They don’t get cheaper with time. And when we choose not to invest (when we say six cents is too much) we’re choosing risk. We’re just hoping someone else pays the price.

So What Now? Scrap It All and Start Over?

Some people say it’s time to abandon the gas tax entirely. Replace it with a statewide sales tax that spreads the cost to everyone, especially tourists.

It’s an idea worth debating. But Oregon voters have rejected sales taxes more times than we’ve had major league baseball proposals. And even if it passed, it would shift us away from a user-based system to something far more indirect. Something harder to tie back to actual road usage.

Sales taxes are broad, yes. But they’re also regressive. Harder on lower-income families. More complex to manage. Easier to raise without notice.

So maybe we don’t need to burn the system down. Maybe we just need to fix what’s broken.

You Can’t See the Bridge That Didn’t Collapse

That’s the real messaging failure here. Nobody celebrates the quiet success stories. Nobody posts about culvert upgrades. Or guardrail reinforcements. Or slope stabilizations. But those are the things that keep us alive. Quietly. Thanklessly. Predictably.

And here’s what I’ve learned in this job: when the system works, it disappears. Which makes it hard to explain. Harder to defend.

Until something breaks.

And then it’s not the system that gets blamed, it’s the people who were supposed to protect it.

That’s why six cents feels like such a big ask. It’s not because the number is crushing. It’s because people don’t believe they’ll see the benefit. They’ve been told before that the money would fix the slide, smooth the bump, or widen the lane, and yet the slide is still moving, the bump still jolts the coffee out of their cup, and the lane is still narrow. Once trust erodes, every proposal sounds like the same broken promise.

So no, I don’t blame anyone for being skeptical. I’m skeptical too. I’ve driven the same roads. Sat in the same traffic jams. Heard the same promises. And I’ve also sat in hearings where the numbers don’t pencil out. Where rural counties get squeezed. Where every option seems to land somewhere between unpopular and impossible.

And now we’re back at that familiar crossroads. Another proposed increase. Another round of frustration. Another call for reform.

So am I ready to raise the gas tax? Honestly, I don’t know yet.

What I do know is this: doing nothing isn’t free. It just sends the bill somewhere else. Usually to the people with the least power to complain.

If we’re going to ask more of Oregonians, we owe them more in return. We owe them honesty about what the tax pays for. Transparency about where it goes. And a funding model that reflects how our communities actually function, not just what a formula spits out.

I haven’t made up my mind. But I know this much: the cost of delay keeps showing up on the roads we drive every day. And until we fix the trust problem, every debate about money will sound like a scam. No matter how honest the math really is.