By Representative David Gomberg, House District 10

10/27/2025

Dear Friends and Neighbors,

Content Warning: I’m going to talk about our state budget. It is not exciting stuff! But budgeting is a core legislative function – often more important than passing policy. Informed citizens should understand it just a little better.

I talk a lot about our state budget, how it affects the economy, the taxes you pay, and the services or benefits you receive. Sometimes it is helpful to step back and look at the big budget picture and what kind of money we’re talking about.

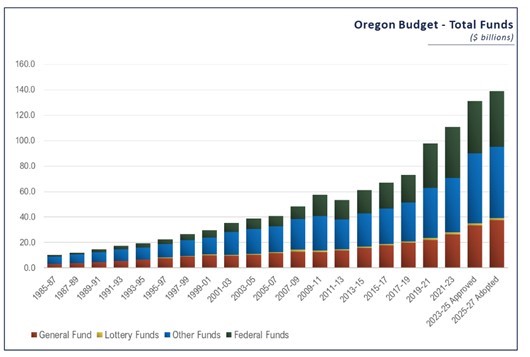

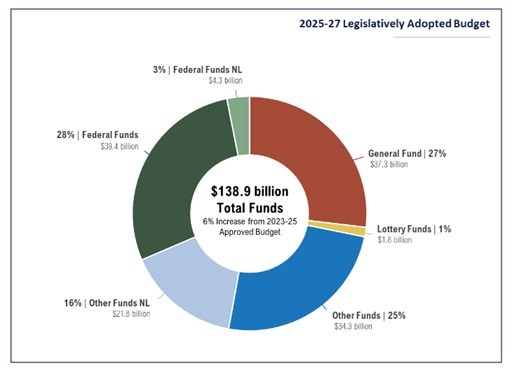

Budget resources or income include Federal Funds, General Funds, Lottery Funds, and Other Funds. Federal Funds are dollars sent to Oregon from Washington DC, often for specific purposes. General Funds are your income tax dollars and corporate taxes. Other Funds are fees and special taxes, like gas taxes or professional licenses. And Lottery Funds are the monies produced through the Oregon Lottery and related bonds.

We budget in two-year cycles called a biennium. We budget in two-year cycles called a biennium.

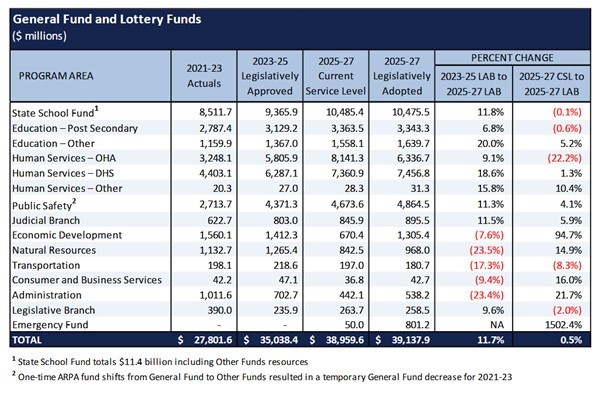

The legislatively adopted budget (LAB) for the 2025-27 biennium is $138.9 billion total funds, which is an increase of $7.7 billion, or 5.9%, from 2023-25. The total budget for 2025-27 includes $37.3 billion General Funds, $1.8 billion Lottery Funds, $56.1 billion Other Funds, and $43.7 billion Federal Funds. Combined General Fund and Lottery Funds of $39.1 billion increased 11.7% over the prior biennium. The increase is largely due to an 11.8% increase in General Funds. The General Fund has seen a continuing trend of double-digit growth since 2013-15. But current projections see that number leveling off. The following charts provide a history of Oregon’s total funds and General Fund and Lottery Funds budgets from 1985-87 through the 2025-27 biennia: |

|

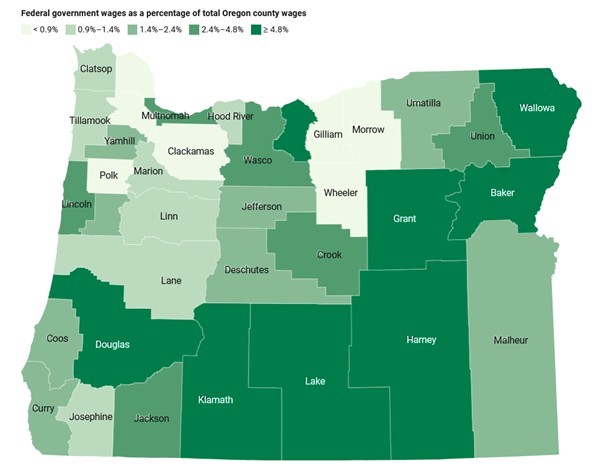

| In addition to General Fund changes, revenue forecasters are now projecting reductions in Other Funds and federal funding. As changes in the projected revenues for the biennium occur, the Legislature may be required to make adjustments to the budget. That’s unusual.

A constitutional amendment adopted by voters in November 2010 changed the historical Oregon every-two-year process into annual legislative sessions. The session is limited to 160 calendar days in odd-numbered years when a two-year budget is adopted. The Oregon Constitution requires that budget to be balanced. The “short” session in even-numbered years is limited to 35 calendar days. Budgets can be adjusted in the short session. Special sessions can also be called. Development of the 2025-27 budget followed a fairly normal course during the 2025 session:

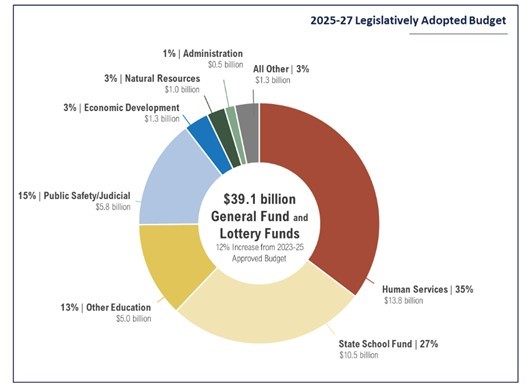

The total 2025-27 legislatively adopted General Fund and Lottery Funds budget by program area is reflected in the chart below: |

|

| General Fund and Lottery Funds expenditures of $39 billion this biennium included $271.9 million in targeted reductions.

In making reductions, subcommittees often made difficult decisions to prioritize programs that resulted in the least impact on needs and service levels. The budget also reserved funding for changes in state employee compensation, a general-purpose Emergency Fund, and special appropriations to address health and human services caseload changes and natural disasters. Generally, funding for schools, health care, and housing went up. Other spending went down. |

|

| The May 2025 economic and revenue forecast reflected a $532.2 million decline in forecasted General Fund and discretionary Lottery Funds resources from the level projected in March when the budget framework was produced. This required the budget plan to be rebalanced in the last few weeks of session to accommodate the lower level of available resources.

Not all available income was spent. The budget retained a 1.5% General Fund ending balance and a discretionary Lottery Funds balance of $45 million to meet a statutory Rainy Day Fund deposit requirement and support possible cost increases during the biennium. If you want to read more. The Oregon Legislative Fiscal Office has published its 2025-27 Budget Highlights report. Read the full report here. So …. If you are still reading, the bottom line is that costs are going up faster than revenue, and that revenue is declining. We approved a two-year budget and will soon need to change it. With a better understanding of changes wrought by federal tax adjustments and a decline in federal fund sharing, agencies are already being asked to plan for further reductions and the legislature is preparing to reduce spending by roughly one billion dollars. As we engage in this difficult belt-tightening process, some lawmakers are asking if we can budget better. As I explained earlier, Oregon budgeting begins with the current service level – what we are spending now – and adjusts by either considering cost increases or eliminating programs. What’s the alternative? There’s a concept called zero-based budgeting. Oregon doesn’t use it. Zero-based budgeting requires each agency to justify every program and every expense for the next budget cycle. It’s like building each budget from the ground up. “If we were starting over, is this what we would do?” Trying to take that approach when each agency is before the budget committee for just a few hours is not practical. The work is time-consuming and labor-intensive. But it can ensure the agency’s work aligns with the state’s priorities. Read more in the Capital Insider. |

|

|

|

|

|

|

|

|

|