By Representative David Gomberg, House District 10

5/19/2025

For several weeks I have been writing about the May revenue forecast.

Before we can leave Salem at the end of June, the state constitution requires us to complete a balanced two-year budget. In order to know how much to spend, we first need to know how much money we have. That answer came in a formal report presented this past week.

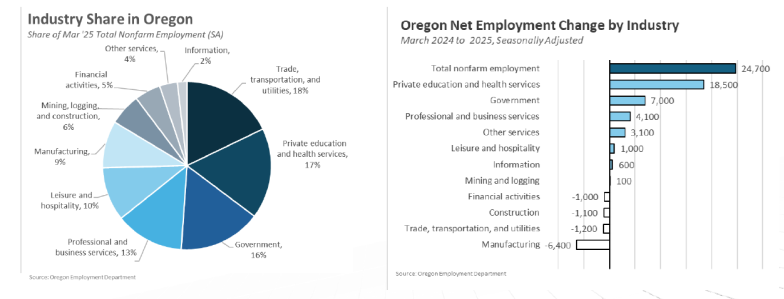

State economists now say they expect Oregon will have around $500 million less to spend in the 2025-27 budget cycle than anticipated just three months ago. The drop is largely due to reductions in projected personal income taxes as Oregonians’ employment rates, wage growth and capital gains decline.

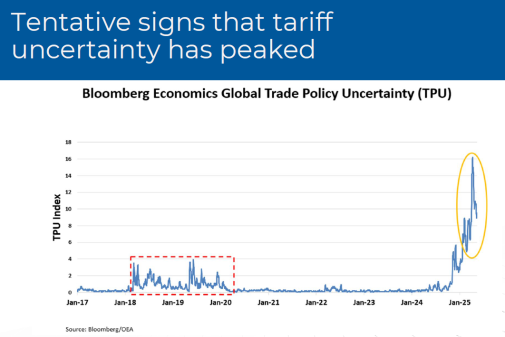

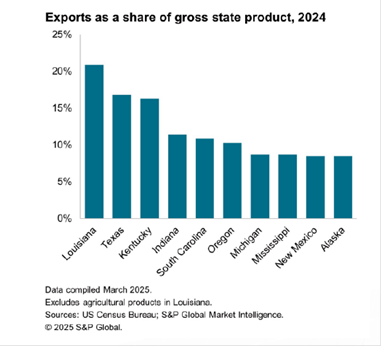

Economists said the rest of 2025 will be characterized by sluggish economic growth due to existing tariffs and uncertainty around the future of tariffs, especially in the manufacturing and construction sectors. Tariffs disproportionately hurt coastal states and states with large ports like Oregon.

|

| This is a reduction but not a huge one. And even with the reductions, the state is expected to have billions more to spend in the next two-year budget than it did for the current one.

But like your own household budget, the state is looking at higher costs that offset higher income. We’ve spent the past months of session reviewing agency budgets and preparing targeted reductions. News this week likely won’t be enough to force large additional cuts at state agencies. That means we can soon start to move budgets for larger state agencies that have already been studied and trimmed. Still in question are potential investments proposed by Governor Tina Kotek that include more than $800 million to bolster housing and homelessness, $246 million for the state’s behavioral health system, and $200 million for education. And Oregon, like other states, is waiting to see whether congressional Republicans will push through proposed cuts to Medicaid. That could drastically reduce federal money the state uses to provide health care to low-income people. The weak forecast could also doom many bills introduced by individual legislators that have been on hold in the Capitol. That includes low-cost proposals like my suggestions to get more Oregon seafood into school lunch programs, improve emergency water and generator fuel storage at our hospitals, or create an Animal Trust to raise funds for low-income veterinary services and spaying and neutering of dogs and cats across Oregon. The revised forecast is a reflection of a national economy that is grappling with uncertainty because of ongoing trade tensions, and is now growing far more slowly than many economists had anticipated. That impacts corporate and business income taxes, which are leading drivers of the state’s general fund budget. Taxpayers can also expect a smaller “kicker” tax refund as a result. The rebate — triggered when actual revenues come in at least 2% higher than what lawmakers budgeted for — has been revised to $1.64 billion, a $87.5 million decrease. The quarterly forecasts take into account all of Oregon’s major revenue sources, including personal and corporate income taxes — which make up the bulk of the state’s general fund — as well as lottery revenues and the Corporate Activity Tax. |

|

| Here are more specifics:

Revenue Outlook: 2025-27 Net General Fund revenue is $35.6 billion, down $337.1 million from the March 2025 forecast. The 2025-2027 General Fund net resources are now $37.4 billion versus March projected net estimate of $38.2 billion, a decrease of $755.7 million. Lottery revenue for the 2025-27 biennium is down $42.3 million from the March 2025 forecast. Reserve accounts as of March were $978 million (Education Stability Fund) and $1.76 billion (Rainy Day Fund). The projected ending balances for the 2023-25 biennium reserve account are as follows: Education Stability Fund: $1.01 billion and Rainy-Day Fund: $1.91 billion. The Rainy-Day Fund is projected to receive $334.7 million following the end of the 2023-2025 Biennium. Kicker Outlook: A personal kicker of $1.639 billion is projected for 2025. Corporate tax revenue of $915.9 million is projected to be dedicated to K-12 education spending in 2025-2027. Economic Outlook: The overall economic forecast reflects sluggish national growth and a mild deceleration in Oregon’s labor market. Oregon’s employment fell short of expectations in Q1 2025, and the unemployment rate rose to 4.6%, up from 4.1% a year ago. Personal income growth also came in below forecast, with Q1 income data down 0.8% from March projections. Looking ahead, population growth is expected to remain modest, averaging 0.5% annually through 2035. While labor market conditions remain relatively stable, the forecast notes a heightened risk of recession and continued uncertainty tied to national trade and fiscal policy. Corporate Activity Tax (CAT) Projections: Anticipated revenues for the current biennium (23-25) are down $21.8 million to $2.74 billion. For 2025-27, projected revenue is now $3.07 billion, down $44.4 million from March. Forecast Documents:

Federal uncertainty has led to Oregonians being more cautious about spending hard-earned dollars and a slow-growth business economy. The uncertainty is slowing the economic activity that fuels state revenue in normal circumstances. Coastal states can feel the brunt of tariffs enacted at the federal level because of Oregon’s trade-heavy economy and our shipping container ports. Our state’s economy relies more on manufacturing and trade than most states, and it is especially impacted by tense trade relationships with countries like China. There are also deep concerns for families afraid of losing long-term care for aging parents, federally funded preschool for their children, and special education funding for students in our K-12 public school system. Domestic violence and sexual abuse centers rely heavily on federal funding to help survivors seek safety through shelter, counseling, and support services. These are real people, with real, immediate needs. |

|

| The positive news is that Oregon has done a good job of funding our reserves with about $2.5 billion in the Education Stability Fund and Rainy Day Fund. I’ve been asked why we don’t use these accounts to offset agency cuts to transportation costs. The answer is that emergency accounts are for one-time expenses and not ongoing expenditures.

Where we are today will require us all to work together for solutions and priorities to give Oregonians across this state assurance that together we will prevail, no matter if in Burns or Beaverton. We must continue to collaborate, plan for the real possibility of additional revenue decline, and keep Oregonians informed, aware, and engaged on the process. Read more here: President Trump’s escalating tariffs could slow down Oregon’s economy – OPB Oregon’s revenue forecast shows economic slowdown – OPB Politics Now |

|

|

|

|

|

|

|

|

|

|

|

With the possibility of another challenging fire season ahead, preparing your home could make all the difference.

With the possibility of another challenging fire season ahead, preparing your home could make all the difference.