| I want to share some more encouraging news. The Oregon Treasury just released a new report, Tracking Net Zero and Climate Positive Investment Strategies. The data show that making profitable, climate-positive investments can be in the best financial interests of public employees and all Oregonians, not in conflict with them.

The report looks at the Treasury’s progress in implementing former Treasurer Read’s Net Zero plan, which was released in 2024. The results are promising:

- Emissions intensity in the Oregon Public Employees Retirement Fund (OPERF) dropped by 50%.

- Climate-positive holdings in the Real Assets portfolio nearly doubled, increasing from $1.2 billion in the 2022 baseline year, to $2.4 billion as of June 30, 2025. They were the asset class’s best performing sector over the past 5 years, delivering a 20 percent return.

- After increasing from 2022 to 2023, fossil fuel holdings in private market funds have declined in each subsequent year through June 30, 2025.

During this time, investment returns for the state public employee retirement fund exceeded the rate the PERS board uses to determine the unfunded actuarial liability–which in turn affects contribution rates for public employers and funding for the programs they deliver.

Put simply, emissions are down, and profits are up.

Why? Global markets are shifting rapidly toward cheaper and cleaner renewable energy and other climate-positive technologies—and away from fossil fuels. At Treasury, investment officers (and the fund managers we work with) are looking at market fundamentals, long-term demand, and structural shifts in the global economy to reduce risk and find opportunities. In the long term, climate-positive investments continue to look like a better bet.

As a result, climate positive investments are helping us stay true to our fiduciary responsibility to teachers, firefighters, and other public employees—and every Oregonian who relies on the services they provide. |

I hope each of you had a safe and wonderful weekend and observance of Martin Luther King Jr. Day. Monday was not simply a day off, but a day to remember and honor a man who truly embodied the spirit of justice, equality, and service. May we follow in his footsteps by speaking out against and fighting injustice wherever we see it. His example and words remain profoundly relevant today.

I hope each of you had a safe and wonderful weekend and observance of Martin Luther King Jr. Day. Monday was not simply a day off, but a day to remember and honor a man who truly embodied the spirit of justice, equality, and service. May we follow in his footsteps by speaking out against and fighting injustice wherever we see it. His example and words remain profoundly relevant today. Philomath High School was ranked 12th in the state (out of 340 Oregon High schools) by US News and World Report. This was the highest ranking of any high school outside of the Portland Metro area.

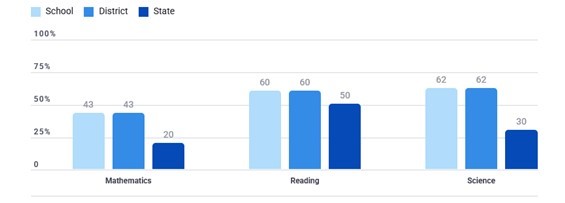

Philomath High School was ranked 12th in the state (out of 340 Oregon High schools) by US News and World Report. This was the highest ranking of any high school outside of the Portland Metro area.