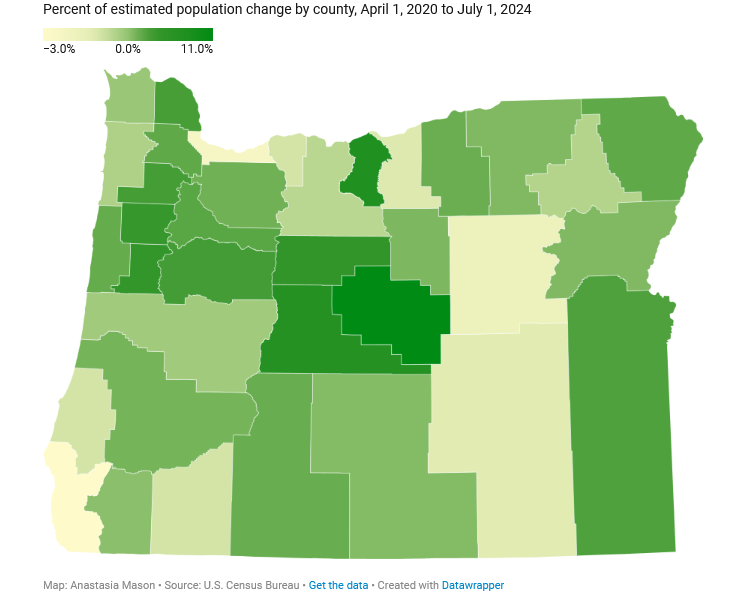

| Loss of population is of concern to school administrators, employers, and state economists. Population growth is core to Oregon’s economic health. A low birth rate and aging population mean Oregon leans on its working-age residents to shop, pay taxes, and bolster the state’s labor force.

But the state’s population has been on edge since the pandemic, as the tsunami of young professionals who flooded into Oregon during the 2010s slowed. We saw many people leaving Oregon, especially from the Portland metro area, suggesting a complex migration pattern driven by high costs, remote work, and a search for better opportunities or lifestyle changes. Key factors for people leaving include housing costs, homelessness, wildfire impacts, and taxes, with Washington, California, and Arizona being common destinations.

But now some good news. Oregon experienced the highest percentage of inbound movers in the nation last year, a sign that the state’s population slowdown may be coming to an end.

Interstate hauler United Van Lines released its annual moving survey that shows migration patterns across the U.S. Oregon topped the list for share of inbound movers, with 64.5% of those who moved coming into the state and 35.5% moving out. A company spokesperson noted that 22% of respondents who moved into Oregon arrived from California. Other big sources of in-migrants were Washington and Colorado.

U-Haul’s 2025 migration report echoed those findings. The report found that of the states that saw migration growth in 2025, Oregon ranks 11th, with U-Haul customers making up 50.3% of all one-way traffic in and out of the state. This is also the first time since 2022 that Oregon registers as a net-gain state with more U-Haul customers coming into the state rather than leaving, according to U-Haul.

“We are seeing a boom in the technology sector throughout the state, and there has been more of a recent push by state leadership to have clean energy and a cleaner state. The people who move to and live in Oregon love the outdoors. We have the Pacific Ocean and the mountains. We have all four seasons here and a lot of people appreciate and enjoy that.”

The U-Haul report says notable cities seeing growth include Beaverton, Bend, Corvallis, Happy Valley, McMinnville, St. Helens, Tigard, Florence and Woodburn. According to the report, the top 10 growth states are Texas, Florida, North Carolina, Tennessee, South Carolina, Washington, Arizona, Idaho, Alabama and Georgia – in that order. |