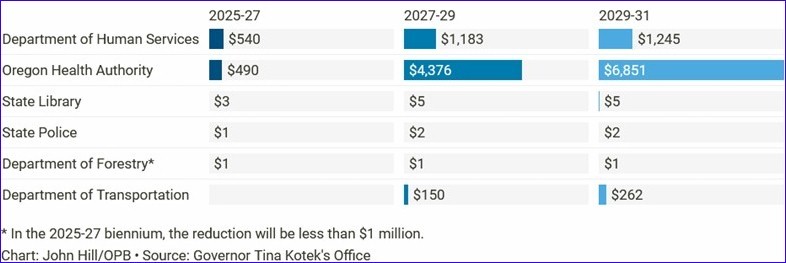

| Oregon stands to lose more than $15 billion in federal funding for health care, food assistance and other purposes in coming years, under the sweeping Federal legislation. That’s the preliminary conclusion by Governor Tina Kotek’s office, which in recent weeks asked state agencies to crunch the numbers for what the so-called One Big Beautiful Bill Act might mean for their ability to provide services.

Kotek’s office says that Oregon will lose out on nearly $11.7 billion that currently funds health care through the Oregon Health Plan. As of June 2025, 1 in 3 Oregonians—and over half of those under age 18—were enrolled in the Oregon Health Plan, according to state health authority data. The more frequent eligibility checks required by the bill will cost upwards of $100 million for the state to implement and will require updates to technology systems and new administrative positions.

Hospitals are still required to provide support to emergency patients who cannot pay. But emergency response is more expensive than ongoing care. And lack of reimbursement will either drive up costs for everyone or further compromise the financial future of local hospitals.

The state’s Department of Human Services expects $3 billion to disappear that helps low-income Oregonians afford food via the Supplemental Nutrition Assistance Program, or SNAP. In Oregon, one in six people access SNAP benefits every month.

Oregon had been promised nearly $200 million in federal funds to fight climate change through the Inflation Reduction Act. But the new budget bill seeks to eliminate much of the federal government’s involvement in climate change response. It reduces investments in climate science, stops federal tax credits for people buying electric vehicles or making homes energy efficient, and it restricts programs that seek to limit carbon emissions from industry.

Oregon will see more logging, but less timber money going to local communities and less support for private forest owners. That’s a change from current practice. Many counties in rural areas rely on a cut of revenues from timber sales on federal public lands to pay for schools, law enforcement and public infrastructure. “They are removing timber receipt sharing, so that timber receipts go back to the Treasury and they are not going to schools,” Democratic U.S. Representative Val Hoyle said Wednesday. “The places they are hurting most are our rural communities” And renewable energy projects planned for federally owned lands could cost much more to develop and run.

Finally, among the most significant impacts of the bill are changes to the federal government’s largest form of financial aid for low-income college students. It also includes a provision that eliminates financial aid that allowed students to borrow funds to cover housing and food expenses.

Read more about impacts to Oregon here.

Reviewing spending programs to save money and reduce deficits is an important government function. However, in this case, most spending reductions are being used to support tax cuts. Opinions vary on whether this is appropriate. According to the Yale Budget Lab, the bill is expected to raise the federal deficit by at least $3 trillion over the next decade.

Read this brief editorial in the bend Bulletin. “We would be fully behind any effort to cut fat out of government. We don’t see much fat here.” |