EDITOR’S NOTE: Tillamook County Board of Commissioners will be putting a measure on the May ballot to increase the Transient Lodging Tax (TLT) in unincorporated Tillamook County from 10% to 15%. There will be town hall meetings for Short-Term Rental (STR) owners and operators (January 16 at 5:30pm, and January 18 at 10 am at the Port of Tillamook Bay board room; virtual options available.). Those will be followed by Public Hearings (Jan 29 + Feb 12).

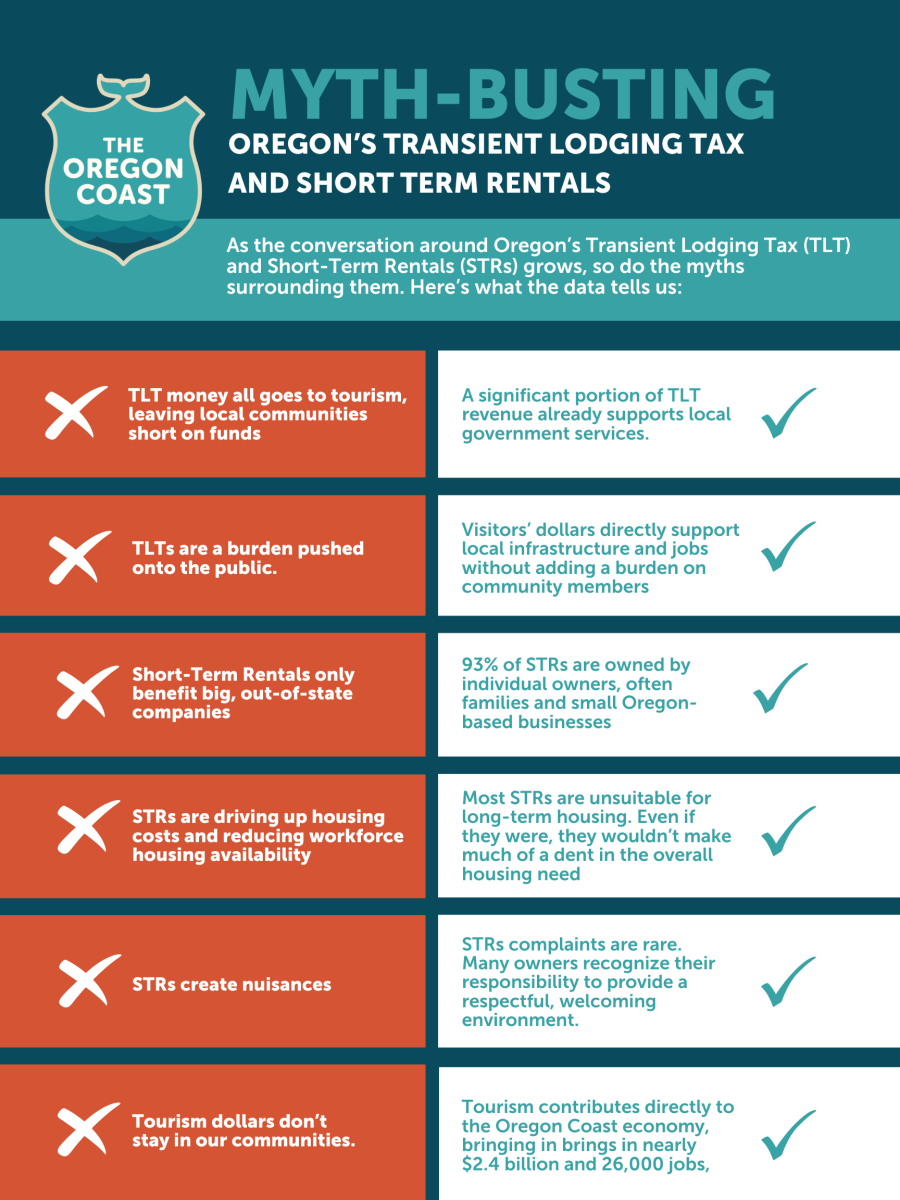

Myth #1: “TLT money all goes to tourism, leaving local communities short on funds.”

Fact: A significant portion of TLT revenue already supports local government services. While newer lodging taxes follow a 70/30 split favoring tourism, most communities have older, grandfathered TLTs where much of the revenue—like 62% in Lincoln City—goes directly into the general fund. Here are some examples of different TLT splits on the Oregon Coast:

- In Coos Bay, North Bend, and in Yachats, 61% goes to the taxing entity, while just 39% goes to tourism.

- In Manzanita, 90% is kept for the general fund with only 10% going to tourism.

Myth #2: “TLTs are a burden pushed onto the public.”

Fact: TLTs are visitor-funded, not resident-funded. In fact, the lodging industry itself proposed the TLT to spur local economies, especially in rural areas. Visitors’ dollars directly support local infrastructure and jobs without adding a burden on community members.

Myth #3: “Tourism dollars don’t stay in our communities.”

Myth #3: “Tourism dollars don’t stay in our communities.”

First established in 1976, Oregon’s TLT was designed to promote tourism while strengthening local economies. Visitor-paid TLT revenue helps fund essential tourism infrastructure—such as trails, visitor centers, and arts venues—as well as marketing. Since 2003, newer TLTs follow a 70/30 split, with 70% going to tourism and 30% to local government. However, the 70/30 split is not as straight-forward as it sounds, and many localities around the state already had established lodging taxes prior to 2003. The allocations for those funds were grandfathered in as they were designated when those taxes were established. All future additions to those taxes must abide by the split.Learn more about the Transient Lodging Tax here.The Bigger Picture: How TLTs Benefit Oregon

Tourism creates jobs, generates income, and provides property and income taxes that benefit local communities. These revenues support local businesses, including restaurants, lodging, and other tourism-related ventures, which in turn create hundreds of jobs for community members. The taxes generated by these businesses and their employees help fund critical public services and improve the overall quality of life in our communities. When managed wisely, TLT revenues create a balance between tourism’s economic benefits and the sustainability of our coastal communities. By fueling local services, jobs, and community infrastructure, these resources enhance quality of life for residents while supporting Oregon’s vibrant visitor economy.

How can you get involved in the discussion?

Start by learning about what your own city or municipality is doing with TLT funds. Attend local meetings, reach out to council members, and share your support for responsible tourism funding that strengthens our coastal towns. Your voice can help ensure that TLT revenue continues to benefit residents while enhancing Oregon’s tourism economy. By getting involved, you’re supporting a sustainable future for the Oregon Coast—one that keeps our communities thriving and welcoming to both locals and visitors.

Here’s more about the benefits of Transient Lodging Tax and short-term rentals for our coastal economy:

About the Oregon Coast Visitors Association

The Oregon Coast Visitors Association (OCVA) is the official Regional Destination Management Organization for the entire Oregon Coast as designated by the Oregon Tourism Commission (dba Travel Oregon). OCVA inspires travel and strengthens collaboration to create and steward a sustainable coastal economy.

OCVA has the honor of working with coastal communities to align partnerships, destination development projects, and destination marketing with the vision of creating “a coastal utopia for all.” This includes coastal stakeholders, new and returning visitors, and the natural resources that make these coveted experiences so magical.