The stock market took a significant hit today following a series of sharp declines across major indexes. On Friday, market indicators suggested that a downturn was imminent, and Monday’s trading confirmed those predictions, with many prominent funds losing more overnight than they have in the past 60 years. As a result, several stocks saw declines of 3% to 5%, contributing to a pervasive red wave across the market.

While the sudden dip might appear alarming, this is likely a market correction—a natural occurrence after a prolonged period of record highs across major indexes. When most stocks are at all-time highs, it’s only a matter of time before investors decide to collect returns, causing prices to drop. This trend is reflected in several key stocks and indexes: Lockheed Martin (LMT) at $541, Raytheon (RTX) at $115, Northrop Grumman (NOC) at $491, and the S&P 500 Index at $5211. Despite the downturn, some stocks remain strong, with Lockheed Martin trading at an all-time high.

Lockheed Martin’s performance stands out amid the market’s turbulence. The company’s stock price reached an all-time high of $541, reflecting strong investor confidence fueled by several factors. Increased defense spending due to geopolitical tensions globally has been beneficial for defense contractors like Lockheed Martin. Technological advancements, combined with Lockheed Martin’s strategic investments in cutting-edge defense technologies, have solidified its position as a sector leader. Recent earnings reports indicate robust revenue growth and profitability, contributing to the stock’s rise. Furthermore, the company’s ability to secure key defense contracts and form valuable alliances has positively impacted investor sentiment.

Lockheed Martin, with its stock trading at an all-time high, demonstrates exceptional performance and growth prospects, distinguishing itself from peers. Raytheon and Northrop Grumman are both trading below their all-time highs, indicating room for growth but reflecting recent market corrections. Despite a slight decline, the S&P 500 remains stable, showing broader market resilience.

The defense sector is experiencing growth due to increased global tensions and technological innovation. This environment has favored major players like Lockheed Martin, Raytheon, and Northrop Grumman. However, Lockheed Martin’s achievement of an all-time high underscores its leadership position and strategic advantages in the sector.

The S&P 500, while slightly down, reflects overall market strength. However, economic indicators such as interest rates, inflation, and geopolitical events continue to influence market dynamics.

Investors should consider Lockheed Martin’s strong fundamentals and growth potential when evaluating investment opportunities. A balanced portfolio across sectors can mitigate risks and capitalize on opportunities within defense and other high-performing industries. Monitoring sector-specific trends can guide strategic investment decisions, particularly in defense and technology.

While the market’s recent dip may raise concerns, it is likely a natural correction following a period of substantial growth. Investors are advised to focus on fundamentals and maintain diversified portfolios to navigate the current financial landscape effectively. It’s important to consider the context. For instance Boeing has been on a downward trend for some time because of headlines around shoddy workmanship. But most rising tides float most boats and the stock market is at all time highs. A dip is expected.

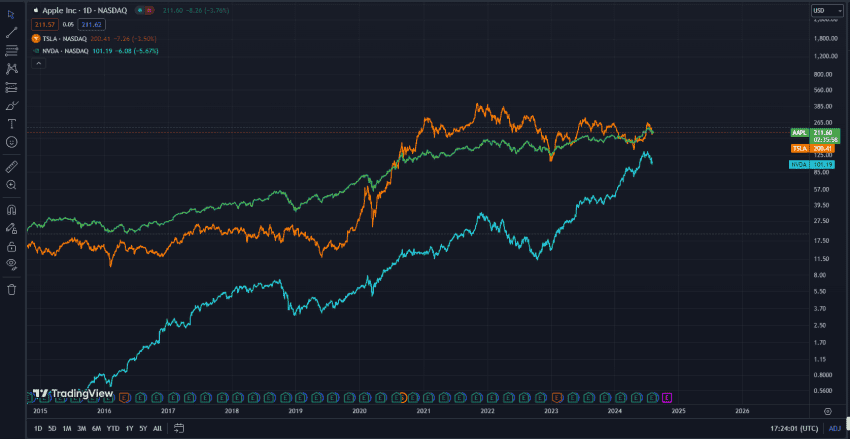

Calm Down by NOTNOTCDM on TradingView.com

Just don’t forget, anything at an all time high isn’t necessarily the best time to buy, and anything performing well over time but in a dip, is a great time to buy for a flip. ~Not Financial Advice~