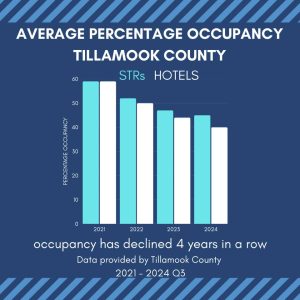

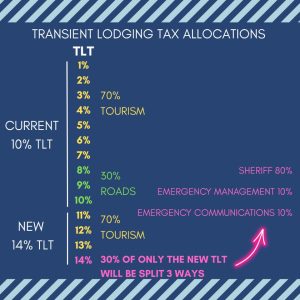

Our Tillamook County Commissioners are asking county residents to vote for a 40% increase, 3 million dollars additional, in the Transient Lodging Tax (TLT). This tax is paid by lodging visitors staying in our hotels and other lodging facilities but the tax actually hurts our community more than our guests.

Tillamook County is not a business center or destination, it is a tourist destination. We have guests primarily from metro Portland attending the Fair, Tillamook Creamery and our beaches and hiking trails. Our guests have a choice of destinations that is in part driven by price. With the price increases we are seeing in food, clothing, energy and any other consumable items makes spending decisions more important and the additional 4% increase in lodging costs will influence the choice of the destination and the way time is spent in the community. If we lose the room sale, local restaurants lose the same sale and so does the community. This translates into lost jobs and community businesses.

The TLT is a burden that our guests bear, the lodging industry tolerates and our local and state governments claim is to help the tourism industry with 70% the money it generates being used to further tourism while the other 30% flows to the local general fund.

Ask yourself or confirm with any lodging business if the 70% of the TLT spent actually benefited or increased the number of lodging guests or room nights as intended from this list of larger projects touted by Doug Olsen.

- Expansion of the swimming pool facilities at the North County Recreation District in Nehalem

- Kiawanda Corridor Project in Pacific City

- Wayfinding signage throughout the County

- Significant planning and improvements at the County owned fairgrounds

- Expansion of the Kiawanda Community Center in Pacific City

- Bike and Skate Park in Tillamook

- Kilchis Point restrooms

- Bay City Arts Center

- Neskowin Beach access ramps

- Port of Tillamook Bay Hangar repairs

- Tillamook Off Road Trail Alliance (TORTA)

- Oceanside Community Club new roof

- Waterfront restrooms in Wheeler

- Garibaldi Depot for the Coastal Scenic Railroad

Our observation is NO the money did not produce any tangible results in additional rooms sold. As an example, had the TLT funds been used to better utilize the Fairgrounds and Tillamook Hanger for additional venues and events of interest from Spring through Fall we could see increased guests and revenue in times that we are not fully occupied. That alone would increase TLT revenue without turning off our guests.

At the first town hall to promote the increase in the TLT, the TLT was described by county staff and their supporters as a “cash cow” and instead of managing the funds to grow tourism now hope to take more dollars at the expense of the community. What happens to the County’s budget if the lodging income falls with less lodging demand? Higher prices always drive down demand, sales and revenue.

Our guests will only pay so much for a room. Can hotel owners absorb the tax increases or lower their room rates to balance out the price? Not likely and not sustainable. Guests may refuse to pay the higher rates and switch to day trips to save on lodging, taxes and dining out while using our free beaches and mountains. Who then pays the taxes to fund community services, the community.

Ordinance #74 Amendment #3 is bad policy. The County must manage their TLT and General Funds as businesses manage their budgets. Spend and save when there are surpluses and cut back when needed but make sure that they are getting the best returns on their investments. Increasing prices to cover a poor return is not a plan for success. Our guests will change their behavior and we will pay the price. Saying no to this proposal is the best policy for the community.

KC Wilson

Ashley Inn of Tillamook

EDITOR’S NOTE: Here is information about the TLT: