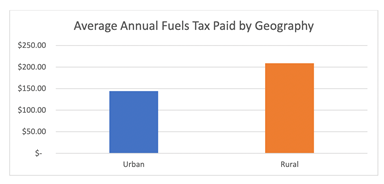

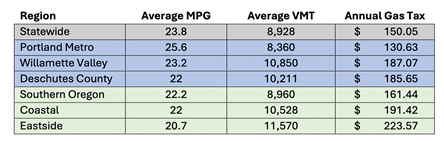

| As I said earlier, the state highway fund is sent back to counties (30%) and cities (20%) based on the number of vehicles registered and population, respectively. What that means is that we drive more, have less efficient vehicles, and because our population is less dense, our cities receive less road revenue back.

Similarly, our visitor traffic affects roads, but does not generate additional road money in tourist areas. Newport gets credit for 10,000 residents and not the 50,000 visitors we may see on a summer weekend.

This is not a new problem. But the changes being proposed present an opportunity for negotiation and improvements.

No one is surprised that this new transportation funding package is controversial. After all, no one likes to see their cost of living go up, or to see the price of everyday goods increase.

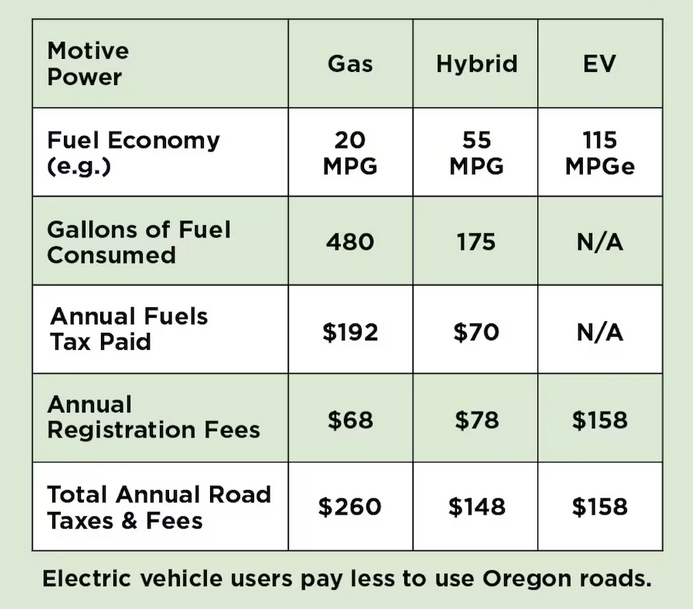

In the minds of the legislators who created it, this package requires the people who use the roads to pay for their upkeep, and it spreads the pain as thinly as possible. For example, by taxing tires, increasing registration fees and adding an EV use fee, it forces electric vehicle users to shoulder more of the burden than they are today. As EVs continue to use and damage the roads, this seems much more equitable to me.

Back in January, I wrote that Democrats have a supermajority in both the House and the Senate. They could, if they wish, pass any bill, budget, or tax without a single Republican vote. And if they did that, it would be wrong.

Republicans, on the other hand, could leave it to the Democrats to sort out these difficult and politically fraught decisions, criticizing us each step of the way, and then poke at us next election season for the hard votes we needed to take. That would be wrong too.

The right way for Oregon is to find the will and courage to work together, negotiate, compromise, and lead – together. That cooperation will produce the best results for all of Oregon.

All of this needs to be accompanied by a strong dose of ODOT accountability. That’s why I’m pleased the Legislature’s top Democrats put a Republican member in charge of finding ways to force more accountability out of our transportation department. I also support regular audits to scrutinize budgets, processes, and management structures.

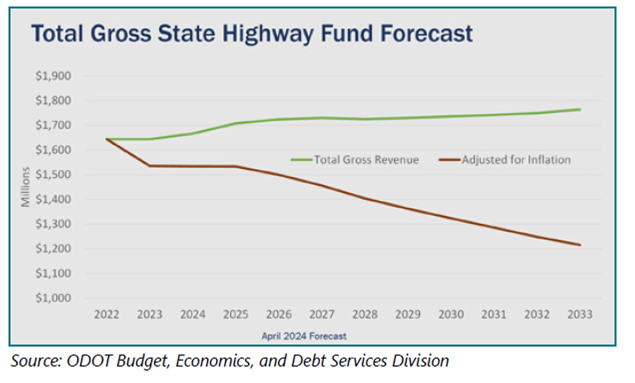

Oregon’s transportation system is essential for a strong economy, our emergency preparedness and responses, and our connectivity. It deeply impacts the daily lives of all Oregonians. Inaction is not an option.

Tough choices will have to be made. Either we slash ODOT’s budget and choose which roads will be closed and which people will not receive service, or we will have to come up with more money. I am hoping that with this package proposal as a starting point, Oregon can find a pathway – or a highway – forward. |